3 reasons to leverage patent data as part of your alternative data strategy

More than 75% of hedge funds currently or expect to use non-traditional data sources to support investments according to research firm EY. Greenwich Associates have found that institutions are spending roughly $900,000 per year on alternative data sources.

Alternative data is big business for the hedge fund industry.

Non-traditional, alternative data sources include satellite imagery used to count the number of cars in big-box retailers car parks; web scraping publicly available data for sentiment analysis purposes; or geolocation data used to indicate consumer traffic to certain stores or locations. Numerous other sources of alternative data also exist, including credit card transaction, point-of-sale transaction, email receipts, product reviews, price trackers, flight and shipping trackers and the list goes on.

One data source not on this list? Patent data.

Seeking alpha

As a fund manager, you are constantly looking for ways to beat the market by either being faster or smarter than your competitors or by taking advantage of another’s mistake.

Broadly speaking, there are only 3 sources of alpha these managers can chase:

- Superior (Private) Information – The strategy chosen by most traditional investment managers. Try to generate a better data set by understanding the underlying economics within a particular industry, or generating more accurate earnings forecasts than your competitors.

- Process Information Better – The strategy chosen by quantitative managers. Assume that most information is publicly and commonly available to all investors and focus on developing procedures to process this information more efficiently and/or effectively.

- Behavioural Biases – Research in psychology and the decision making sciences has documented that in some circumstances investors do not make rational decisions and try to maximize wealth, and in others make systematic mental mistakes due to inherent behavioural biases. These instances can result in mispriced securities investment managers can take advantage of.

What are the benefits of using patent data?

You can gain superior information, and process information better by using patent data delivered to your desk via an API.

You will also gain more of an edge to your decision making because:

- Patent data is (relatively) unused

- Patents have predictive power

- Patent data is a rich and wide data source

Let’s analyse each of these in more detail.

-

Patent data is (relatively) unused

Patent data is still considered to be the realm of IP lawyers or R&D teams. This cannot remain true. The intrinsic value for fund managers is being ignored.

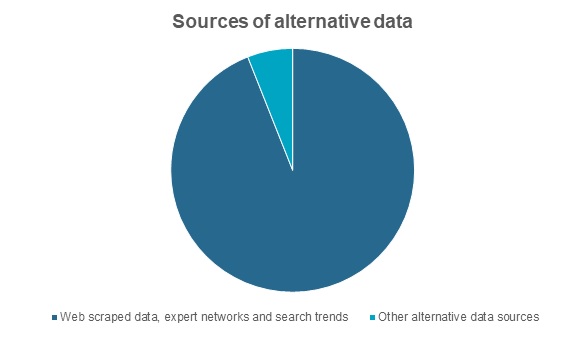

Today, 94% of the alternative data sets currently being used by chief investment officers, portfolio managers and investment analysts are web scraped data, expert networks data and search trends according to “A buyer’s guide to Alternative Data” by Greenwich Associates.

In a recent report, “Alternative data for investment decisions“, Deloitte have warned that “those that do not [accommodate alternative data] could face strategic risks and might well be outmanoeuvred by competitors over the next five years”.

Fig 1. Web scraped data, expert networks and search trends represents the vast majority of alternative data sources. Other alternative data sources includes geolocation, satellite imagery, email receipts, etc.

-

Patents have predictive power

Patents contain detailed information about the underlying company, its prospects and the market in which the firm operates.

A research paper from MIT, “Quantitative Determination of Technological Improvement from Patent Data” found that both the recency and importance of patents filed in technological domains can predict how quickly that technology domain is improving.

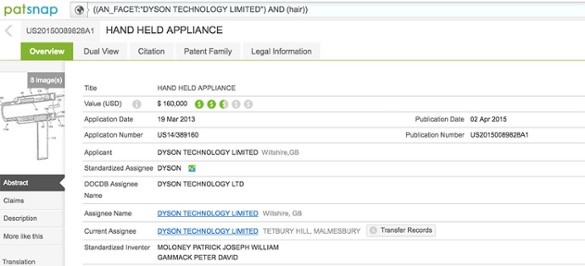

On a company level, as patents are often a proxy for discrete and marketable products, patents can provide up-to-date competitor intelligence. As PatSnap has written about before, Dyson filed a patent for a “hand-held appliance” (the Dyson Supersonic hairdryer) in 2013, which went on sale in 2016. A good investment decision for those with the relevant information to hand.

Fig 2. Dyson’s patent for the Supersonic hairdryer.

-

Patent data is a rich and wide data source

“The data that we find is most impactful for our quantitative investment team includes thousands of companies, compared against each other, on a plethora of points.” according to David Blitz, Head of Quantitative Research at Robeco Institutional Asset Management. “Our work relies on data that covers at least one full economic cycle, but we prefer an even longer-term perspective when available.”

The U.S. Patent and Trademark Office granted companies more than 320,000 patents in 2017. Patent data is a vast, hugely valuable and mostly unrecognised global data set with a long history. The first US patent was issued more than 200 years ago!

Leverage patent data efficiently

Patent analyses can help investors generate increased alpha, providing invaluable data for analysing trends, evaluating company portfolios, identifying innovative companies and evaluating the economic value of a patent portfolio.

Connect by PatSnap opens the door to the most comprehensive, standardized global patent dataset – with unrivalled APAC data coverage. Our API provides access to over 134,000,000 patents, with data for over 18 million unique assignees, across 116 patent authorities, with access to licensing, legal and technology classification data.