How Businesses Use Others Patent Data to Boost Revenue

Intangible assets now make up 80 percent of a business’ value—whereas a couple of decades ago, it would have been tangible assets (such as property and real estate) that had more importance. Individual patents contain valuable details about how an invention is made—but a large collection of patents reveal competitively advantageous patterns of behaviour in the market.

You may not hold any patents but other companies (as a group) are giving away invaluable information in theirs.

The World Intellectual Property Office (WIPO) explains that the objective of competitor intellectual property (IP) intelligence is not to steal a competitor’s property. Rather, it’s to gather information that provides an understanding of a competitor firm’s structure, culture, behaviour, capabilities and weaknesses. Furthermore, Todd Hixon, Managing Director at NAV.VC, explains, “Pay close attention to patents that others hold which might enable competitors to block you… freedom to operate is more important than patent ownership, when evaluating a business plan.”

Millions of patents are filed every year, by organisations across the globe—for example, in 2015, 2.9 million patent applications were filed worldwide, with the highest number in China. Having access to public information about inventions in other parts of the world keeps you well-informed about tangential markets. You can validate your ideas against existing products that have proven successful in other, less visible jurisdictions.

Investors also love patents.

Several researchers have pointed out that technology-based start-ups use patent rights to communicate the quality of their products to investors. Investors and VCs don’t have patents, yet they place a high level of importance on patent intelligence… so why shouldn’t you?

But, in this article, I will focus on 4 main reasons why patent data is a great source of intelligence:

- It provides up-to-date market and competitor information

- It helps you find “low-hanging fruit” (low effort, high yield opportunities)

- It helps you find licensing opportunities (technology you can borrow)

- It helps with due diligence for M&A purposes

Get up-to-date market and competitor intelligence

IP intelligence can give you an insight into the markets in which your competitors are active and whether there are any changes in direction. According to Lemley 2001, patents indicate to outsiders that a company has developed its technology to such an extent that it has defined and carved out a market niche. Early access to information like this can enhance your company’s strategy—you might discover a previously unknown yet lucrative niche, based on your competitors’ movements.

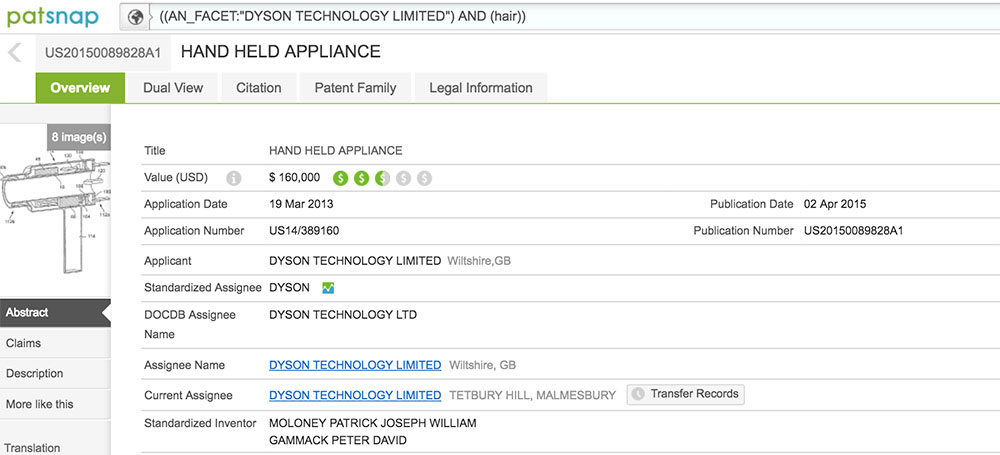

For example, Dyson’s main business used to be based on selling vacuum cleaners. But it filed a patent for a “hand-held appliance” (the Dyson Supersonic hairdryer) in 2013. This indicated that it would likely be moving into the beauty industry—however, the product built using the patented technology wasn’t on sale until 2016.

Had Dyson’s competitors (in both the beauty and vacuum cleaner markets) had early access to this kind of information, they could’ve acted proactively rather than reactively. This kind of insight provides a good basis for exploring lucrative markets.

Dyson’s patent for the Supersonic hairdryer (Source: PatSnap)

Low-hanging fruit from abandoned, invalid and expired patents

Patents prevent others from selling and using an invention. However, they also contain detailed information about how an invention is created. According to the EPO, 80% of technical information can be found in patents. Furthermore, around 85% of patents are no longer in force, because they have been declared invalid, expired or the patent owner hasn’t paid renewal fees. Therefore, these inventions are in the public domain and legally free to use.

Companies can find solutions to technical problems by looking at these patents and use the information in them to develop their technology. Or you can use inactive patent inventions from one industry to solve a technical problem in yours, without fear of infringing.

Expired patents are especially useful in the pharmaceuticals industry. Once a patent has expired, anyone can manufacture, use or sell the product previously protected by the patent. According to Market Realist, once drugs go off patent, generic manufacturers swoop in and tend to acquire 80%–90% of total drug sales.

Patents whose renewal fees have not been paid are considered expired—and if the abandonment was unintentional, other companies can revive the patent for a fee. This is useful information if you’d been previously blocked by a patent, or want to develop a patent portfolio but don’t have the time and resources to invest in R&D.

Blocked by a patent? Get a license.

If you’re a large company that no longer has an R&D function or doesn’t patent anymore, you can still use patent information to find technologies you can license, and use to enhance your products or services. If there’s a valuable invention patented by another company, it may be cheaper—in terms of time, human resources and money—to get a royalty-based license, rather than trying to devise a workaround.

Evaluate M&A opportunities with IP intelligence

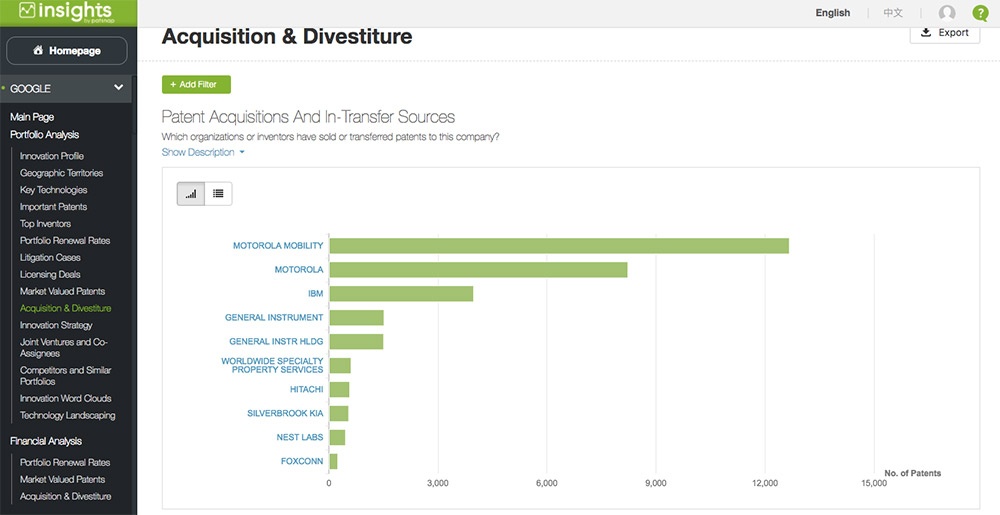

Google is the most notable example of a company that didn’t have many patents but gained significant value by acquiring some. Google was late to the patent game, while Apple was filing lots of them.

In 2011, Google moved into the electronic communications space by acquiring Motorola Mobility for $40 per share.

Google’s acquisition of Motorola Mobility (Source: PatSnap)

According to Google, both companies have a natural fit because Google is great at software and Motorola is good at mobile hardware devices. By acquiring over 12,000 patentsfrom Motorola’s portfolio, Google was able to innovate faster and get a larger market coverage which kept it on par with competitors.

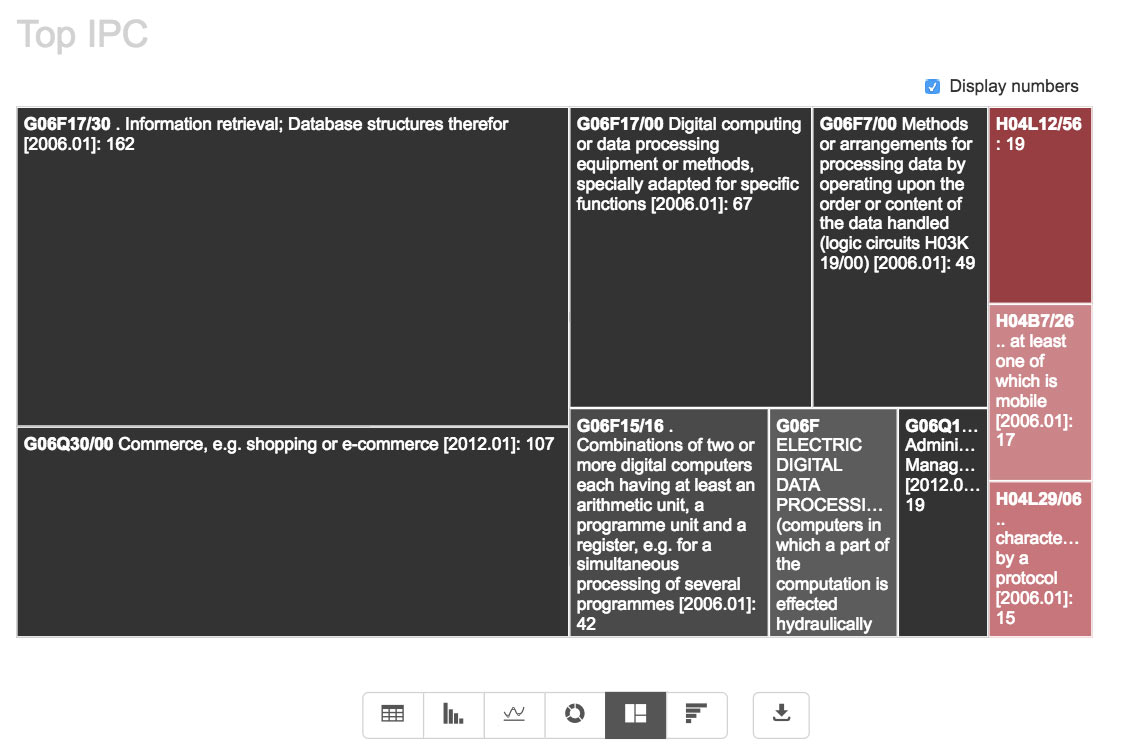

The table below represents the IPC classes to which most patents in Google’s portfolio belong. The International Patent Classification (IPC) is a way of clustering patented technologies into different groups (like a library coding system for book genres).

Google’s patent portfolio, divided into IPC classes, before acquisition of Motorola Mobility in 2011 (Source: PatSnap)

G06 covers technologies for “electrical data processing” and H04 represents “electronic communication technique”. The first image shows the spread of Google’s portfolio until 2011, before its acquisition of Motorola Mobility. Its technology portfolio consisted mainly of class G06 items, with only 51 patents in H04.

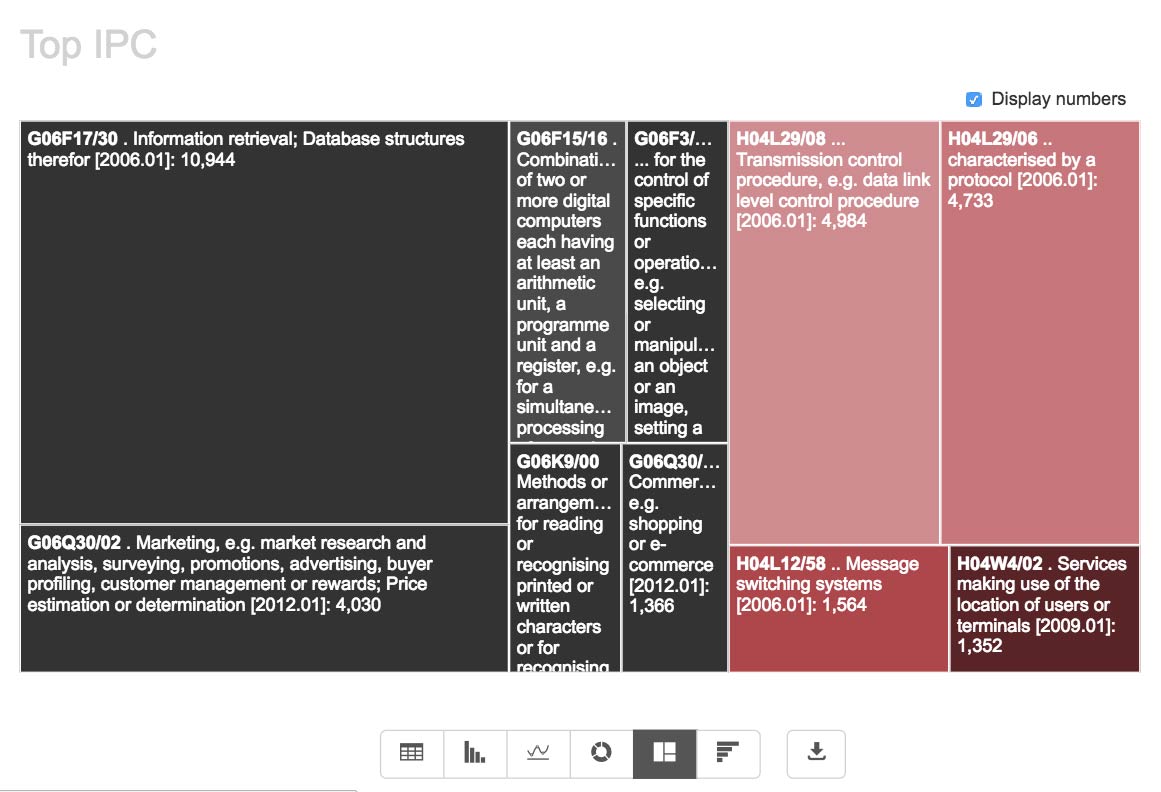

After the acquisition of Motorola Mobility, Google owned a more diverse portfolio—as indicated by the larger number of technologies under H04, (12,633 to be exact). This makes sense because Google acquired Motorola Mobility, a company that manufactures mobile phones. You don’t have to own patents to apply the same winning strategy that Google did.

Google’s patent portfolio IPC table after acquisition in 2011 (Source: PatSnap)

Rather than wasting R&D budget on new products that may not be commercially successful, you can acquire a company with tried-and-true (and protected) technologies— and fill the void in your strategy.

IP information also enhances due diligence on a company’s assets, before the initiation of a merger or acquisition. The data in patents informs you of the value of a company’s assets and how innovative these are, compared with the rest of the market. For example, if a company’s patent is highly cited by other companies and inventors, that suggests the technology is sought after and has great commercial value. IP data also shows you whether the company you’re thinking of acquiring is operating in a highly litigious area, where the unwelcome threat of damages always looms large.

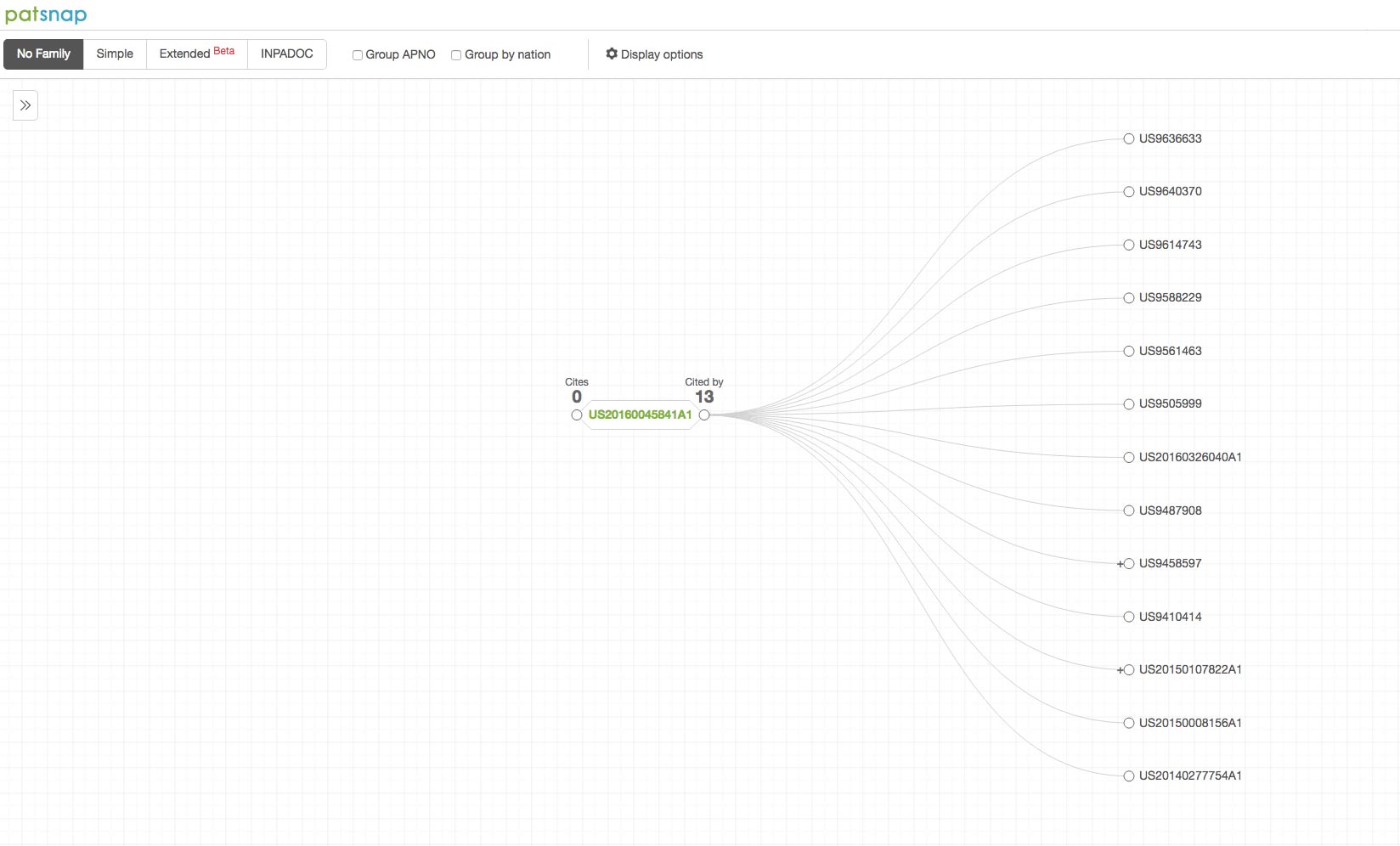

Citation map displaying a patent which has been cited in 13 patents by other companies (Source: PatSnap)

Patent citations can also show you the direction in which the patented technology is developing. If someone cites a patent, it means they’ve developed a unique invention based on the technology protected by that patent. If most of the citations are in relation to advances within a specific technology area, you can gain an insight into other M&A opportunities. For example, the 13 citations in the image above could be by companies that you know nothing about. If you discover that their technology portfolios would enhance the performance and profitability of your organisation, an acquisition might be in order.

When it comes to patents, it’s not necessarily about how many you own—it’s about how much you know.

Your recommended content

-

Meet Hiro Life Sciences: Your Trusted AI Assistant for Accelerated Drug Discovery

Category: Article | Category: Drug Discovery | Category: life sciences

Tuesday, November 26, 2024

AI is revolutionizing drug discovery by providing rapid access to vast and complex datasets, enabling researchers to quickly uncover valuable insights and connections that would be otherwise difficult to observe. By automating routine tasks, enabling advanced analytics, and streamlining workflows, AI is poised to make the entire R&D process significantly more efficient.

-

Patsnap Surpasses US$100 Million in Annual Recurring Revenue

Category: Article | Category: News/PR

Wednesday, June 12, 2024

Patsnap has reached a significant milestone of achieving $100M in Annual Recurring Revenue (ARR), marking an impressive 20% year-over-year growth in 2023. This milestone highlights the massive and meaningful value our platform brings to over 12,000 IP and R&D teams across 50 countries, driving efficiency, productivity, and collaboration.

-

Introducing Hiro, an AI assistant built for IP and R&D workflows

Category: AI advancements | Category: AI development | Category: AI-tools | Category: Article | Category: artificial intelligence

Tuesday, May 14, 2024

Powered by Patsnap’s industry-specific LLM, Hiro is designed to streamline IP and R&D workflows from ideation to product launch. With its robust AI capabilities, Hiro brings a new level of efficiency, precision, and security to tasks that were once time-consuming and labor-intensive.What sets Hiro apart is that it draws from our large language model that’s been trained on market-leading patent records, academic papers, and proprietary innovation data. This ensures we deliver more accurate and reliable results for every prompt.