Embedded Finance: Why Invisible Banks are the Future

Once upon a time, banking institutions and tech companies were separate entities. But this isn’t the case anymore. In this article we’ll explore the rise of invisible banks and what this new model means for both tech companies and banks alike.

In a past life, banking and technology organizations were two different entities. But this isn’t the case anymore. Nowadays, tech companies are becoming banks and banks are becoming tech companies. This trend is materializing with big conglomerates including Amazon, Google, Facebook, and Apple and paving the way for a new banking system to emerge: the invisible bank.

In this article, we’ll explore what embedded finance is and how both banks and tech companies are adapting to changing consumer preferences and tech advancements.

What is Embedded Finance?

Embedded finance is when a business integrates a financial solution into its product offering ecosystem. Currently, we’re seeing countless tech companies adopting this model. As such, embedded finance is quickly becoming one of the most disruptive trends in payments, banking, and technology today.

The barriers to entry are low, which is why tech companies are opting to add financial services to their offerings. We expect to see this snowball in the future, becoming the new normal.

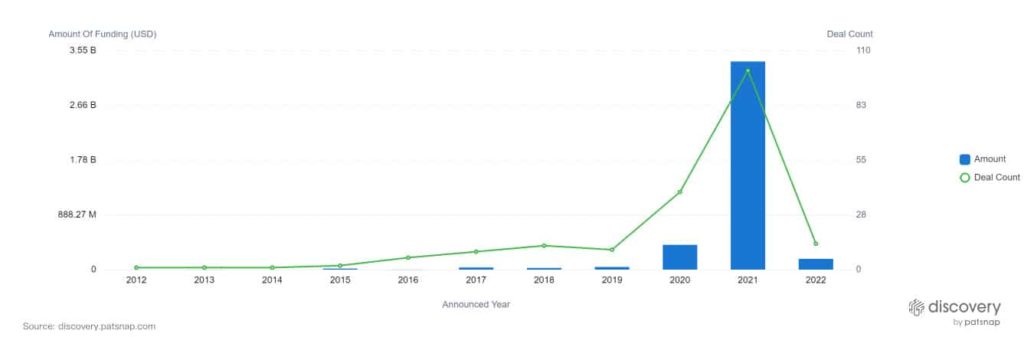

For example, look at the chart below. It illustrates the exponential investment growth of embedded finance. In 2021 alone, a whopping $3 billion was raised across 100 deals. So, what can we learn from this? Embedded finance is reshaping the distribution model for financial services and creating new income streams for tech companies.

Embedded Finance in Action

In early 2022, Apple released “Tap to Pay” on its iPhones. This new feature allows merchants to accept Apple Pay, contactless credit and debit cards, and other digital walls with one single iPhone tap. Not only is Tap to Pay safe and secure, but it’s also cost effective. Merchants can leverage their iPhones, as opposed to expensive point-of-sale (POS) systems to accept consumer payments. After the new feature was announced shares of Block Inc. (formerly Square) dropped by about 3.2%.

These days, embedded finance is virtually everywhere. Here are a handful of well-known examples:

• POS solutions: Light6speed, Block Inc.

• E-commerce software: Spotify, Squarespace

• Ridesharing companies: Uber, Lyft

• Large consumer tech companies: Apple, Google

• Telcos offering digital banking products: Orange Money, T-Mobile Money

By embedding financial services in their plans, these companies are developing richer and stickier customer value props.

Banks Expanding into Tech

Not willing to be left behind, banks are also busy updating their ecosystems to stay on trend. Bank conglomerates including JP Morgan Chase, Barclays, HSBC, and Wells Fargo (to name a few) are exploring the use of blockchain technology for payment processing.

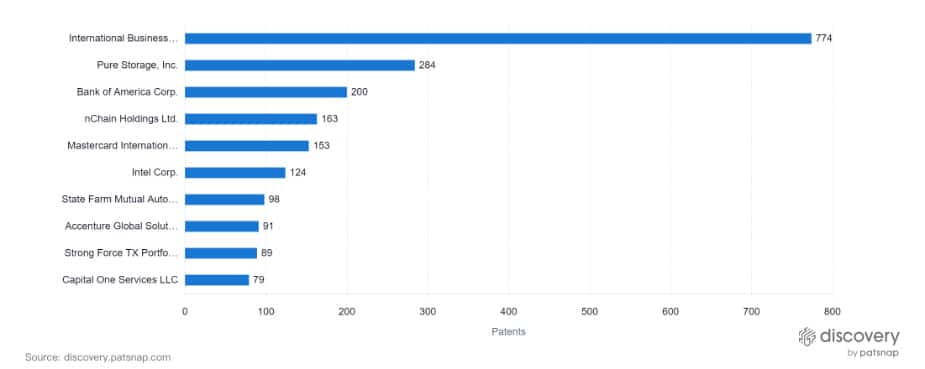

The graph below showcases the top blockchain patent filers in the United States. As you can see, Bank of America is the third most prevalent patent filer. The race to develop new applications highlights a sector-wide desire for change to traditional financial systems, as this is a fast-moving environment, and no one wants to be left behind. Banks are pushing the traditional boundaries of operation and expanding their market control via innovation.

Blockchain technology opens opportunities for banks to use technology to improve other services and compliance activities, which are less likely to be subject to disintermediation. This offers various advantages, including automating tedious processes and reducing the likelihood of human errors, which may create compliance issues.

A blockchain-based registry would not only remove the duplication of efforts in carrying out identity checks, but it would also allow encrypted client updates to be distributed to all banks in near real time. In addition, the archive would provide a record of all documents shared and compliance activities undertaken for each client. These insights may then be used as evidence that a bank acted in accordance with regulatory requirements. Plus, it would help banks pinpoint people attempting to create fraudulent histories and spot criminal activity.

Embedded Finance and Consumer Trends

There are two major trends driving embedded finance forward. These include:

- The move towards a cashless society

- The desire for a simplified, seamless UX

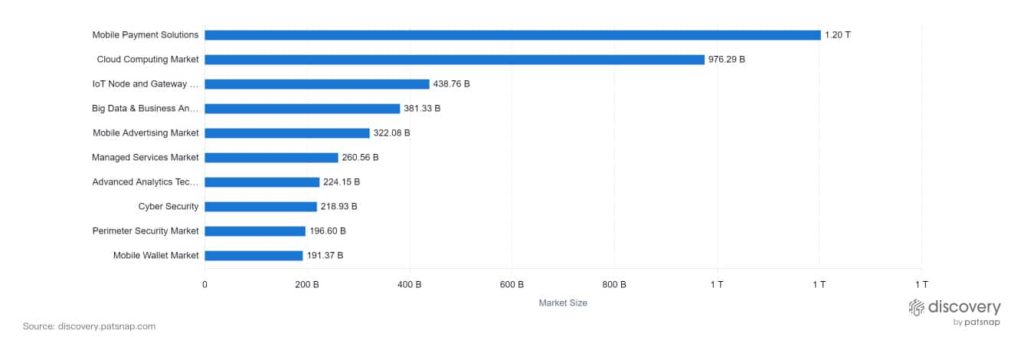

In this section, we’ll explore both of these trends in detail — starting with number one. As the chart illustrates below, the largest market sector in the financial services/technology industry is mobile payment solutions.

Sending money via smartphones is already the norm, and as tech advancements continue at a rapid pace with blockchain gaining major tractions, these payment types will increase in frequency. Soon, we’ll be able to send money back and forth between contacts on our phones without leaving a messaging app or logging into a bank account. Since tech is driving and enabling these advances, it’s expected to be the technology companies, rather than the banks and financial institutions, that are likely to drive these transactions.

Now, let’s not forget about the crucial role user experience plays in improving and adapting technology. To determine necessary optimizations for a simplified, seamless UX, tech companies capture and analyze data in real time, which allows them to tailor recommendations to individuals and create a custom experience. Although data capture is nothing new to Big Tech’s operations, it is new to more traditional financial institutions. Fortunately, blockchain may be the solution these organizations need to stay ahead. As traditional banks catch up, there’s renewed focus on also integrating AI and machine learning to enhance the customer experience.

Embedded Finance and Technological Advancements

There’s no question about it — the pandemic accelerated the adoption of technology across nearly every industry and sector, magnifying our dependence on tech advancements. For example, to stay safe, many merchants adopted cashless and contactless payment models, changing how consumers and businesses interact.

As technological advancements continue to disrupt the traditional ways of banking, we’ll see a whole new spectrum of faster, more secure banking solutions from not only traditional banks, but also Big Tech companies.

Author Bio

Kate White is the Customer Advocacy Manager at PatSnap. She spends her days learning about and promoting PatSnap customers by highlighting their groundbreaking innovations. Kate holds a Bachelor’s degree in Medical Sciences and Psychology from Western University. In her spare time, she enjoys painting and being outside with her Siberian Husky.