How to Showcase Your Exit Strategy and IP Portfolio Value to Investors

When investors put money into a company, they want to get more money out of it. And unless you IPO, if investors don’t get exits, they don’t have a return.

In the pharmaceutical and biotechnology industry, we’re seeing more and more smaller companies looking to get acquired by larger, wealthier competitors. But acquisitions can be a gamble, especially if a company’s true value—including intangible assets such as patents—aren’t properly accounted for. According to Jon Calvert, CEO of ClearViewIP, “Certain crucial aspects of a business’s worth are often overlooked… Value of IP is often misattributed, with large corporations sometimes overlooking their IP positioning.”

So, how can you make the most of an acquisition as part of your company’s exit strategy? More importantly, how can you use IP data to show your investors that your exit strategy will bring them value?

Understand the value of your IP portfolio

It helps to identify the market valuation of your patent portfolio as well as those of your competitors’. This attaches a monetary value to your patents, in comparison with those of other companies in negotiations with investors and potential acquirers.

For example, if Gilead were to use patent data in negotiations with acquirers, it could highlight its highest market-valued patents with longer active lifespans. The image below shows one of Gilead’s patents that’s worth over $11 million and still has a while until expiry.

(PatSnap platform)

You can also show the value of your patents using metrics such as number of citations, patent families, patent renewals and patent litigation history. Analysing these can help you negotiate a better acquisition deal and reassure investors.

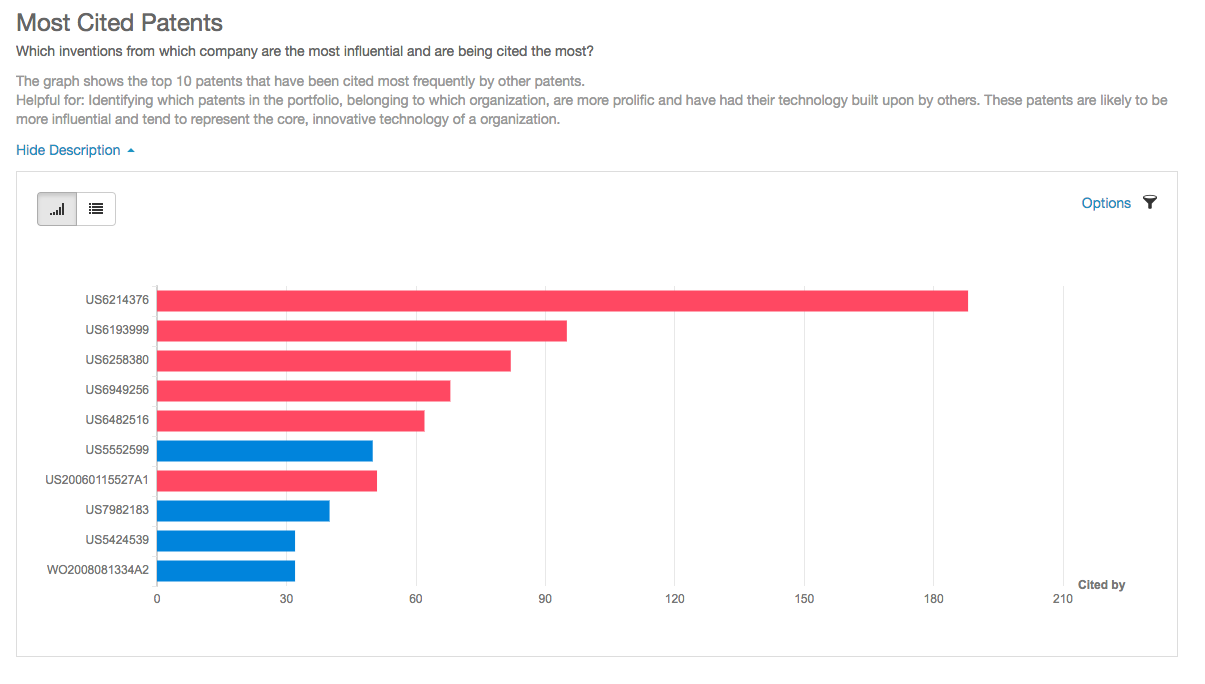

Forward citations

If many companies are citing your patent, it’s usually because they’re developing technologies related to your patented invention. Number of citations can signal that signal that people are interested in your technology and could be potential licensees.

For example, the image below compares Thermo Fisher’s most cited patents with Patheon’s, and Patheon comes out on top.

(PatSnap platform)

Number of patent families

If your patent belongs to a large family, this means you have invested time and money in protecting your invention in multiple countries. This could indicate that your patent is valuable and could help negotiate a higher-value acquisition deal.

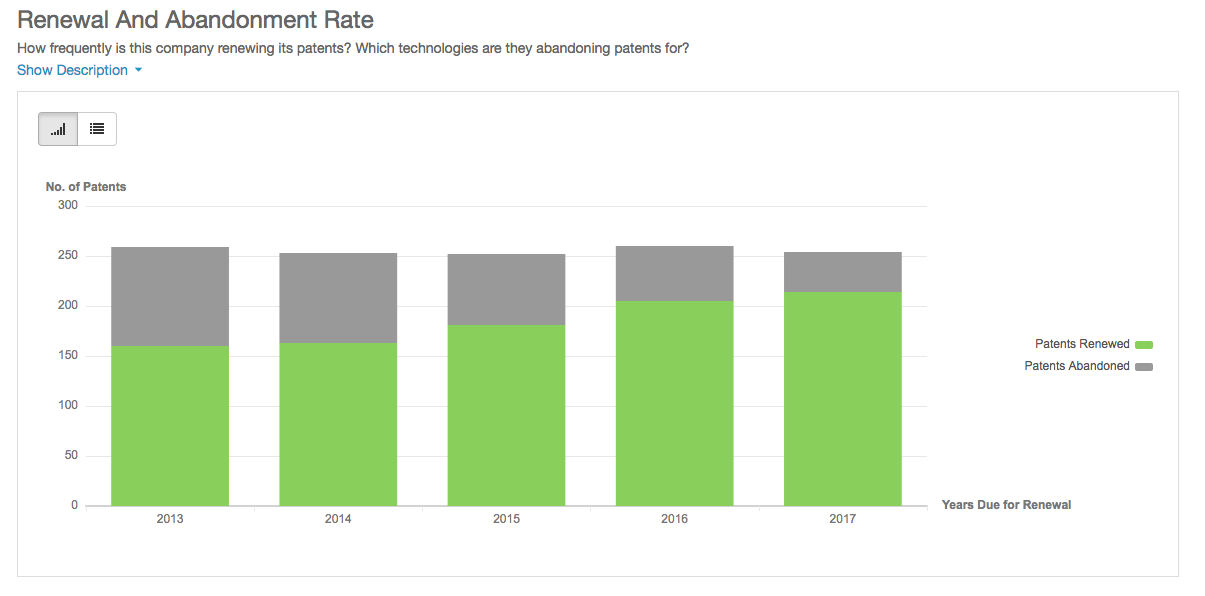

Patent renewal and abandon rates

A patent portfolio with a high abandonment rate could signal a low return on investment (ROI) or value to investors and potential acquirers. But a portfolio full of renewed patents shows a desire to protect technology still considered valuable. This makes your company appear more attractive.

Displayed below is Pfizer’s patent renewal and abandon rates. We can see that more patents are being renewed than abandoned, and this trend is increasing over time.

(PatSnap platform)

Patent litigation

If your patent has been litigated against many times, this could suggest to investors that many other companies are interested in the technology protected by it. Litigants wouldn’t invest the time and money in suing unless they could foresee a much greater potential for monetary reward.

Patent data can show your portfolio’s strength to investors

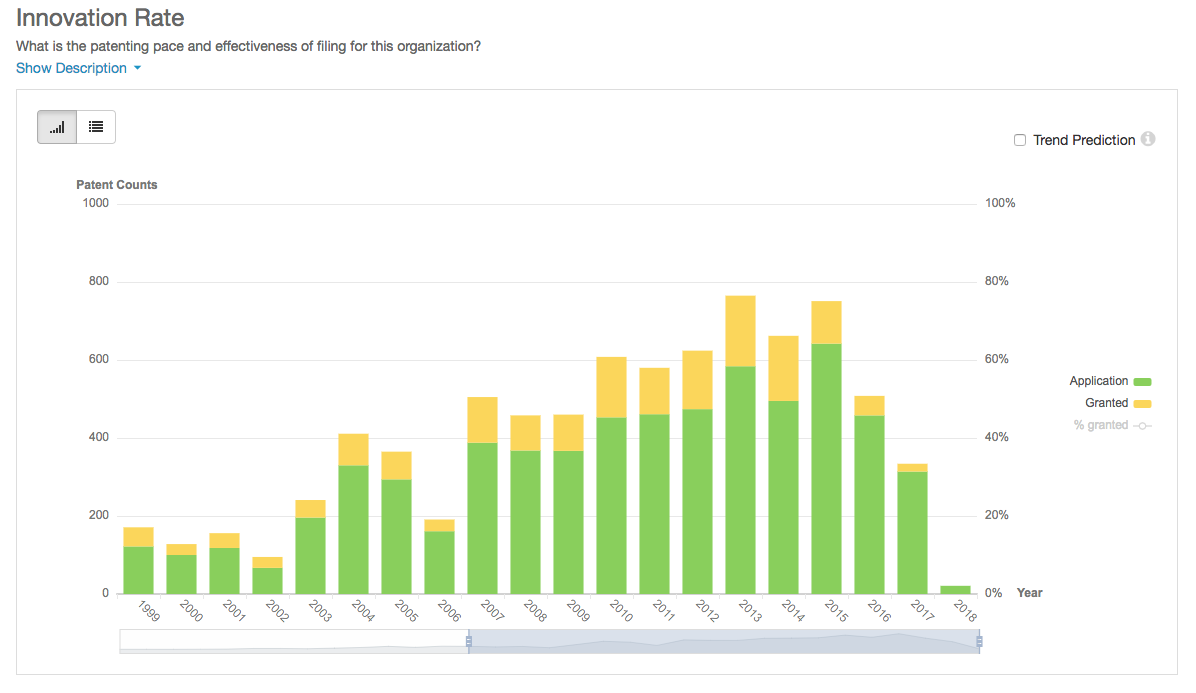

Data points illustrating qualities like innovation rate and geographical presence, can help showcase the strengths of your portfolio to investors.

Innovation rate refers to the number of patents filed every year—even better if you can see what percentage of those patent applications are granted. A chart displaying a high grant rate suggests to investors that most of your technologies are novel. Potential acquirers may also see this as a competitive edge, which could enable you to negotiate a more lucrative acquisition deal.

(PatSnap platform)

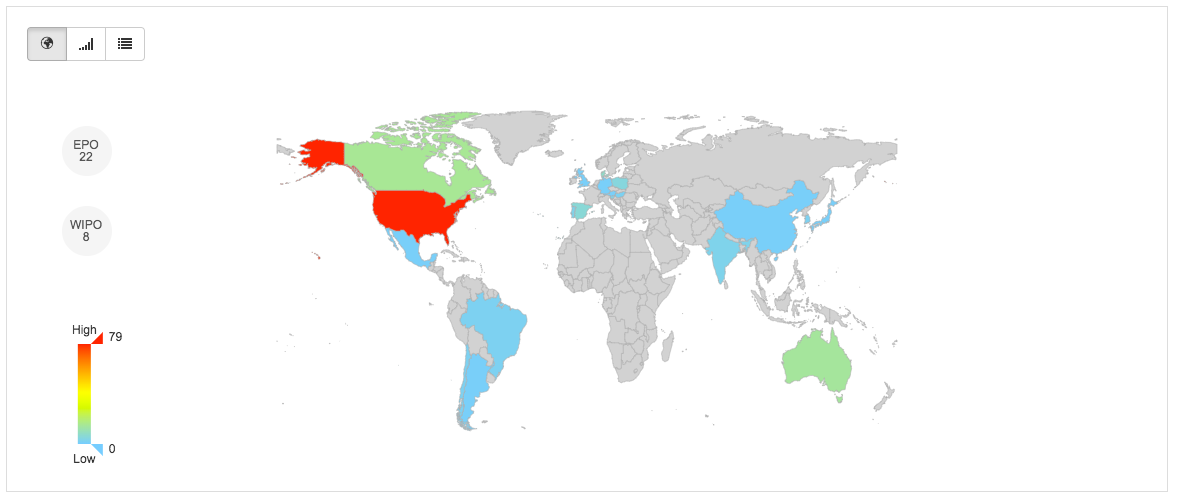

The geographical presence of your patents can show investors that your technologies are well protected internationally. If you’re getting acquired by a multinational company, this information could also demonstrate to your investors, the markets that you could penetrate under the wing of a bigger company. For example, the CEO of Thermo Fisher, Marc Casper, explained one of the reasons for the acquisition of Patheon in 2017 was because there were opportunities to build out Patheon’s footprint in Asia—a market which Patheon hadn’t really penetrated.

(PatSnap platform)

Alternatively, if you have patent protection in a country in which the potential acquirer doesn’t, you could show your investors that you’re in a stronger negotiating position.

Patent data can show your investors how compatible you are with an acquiring company

Compatibility can be assessed by comparing two companies’ key technologies and analysing patent landscapes.

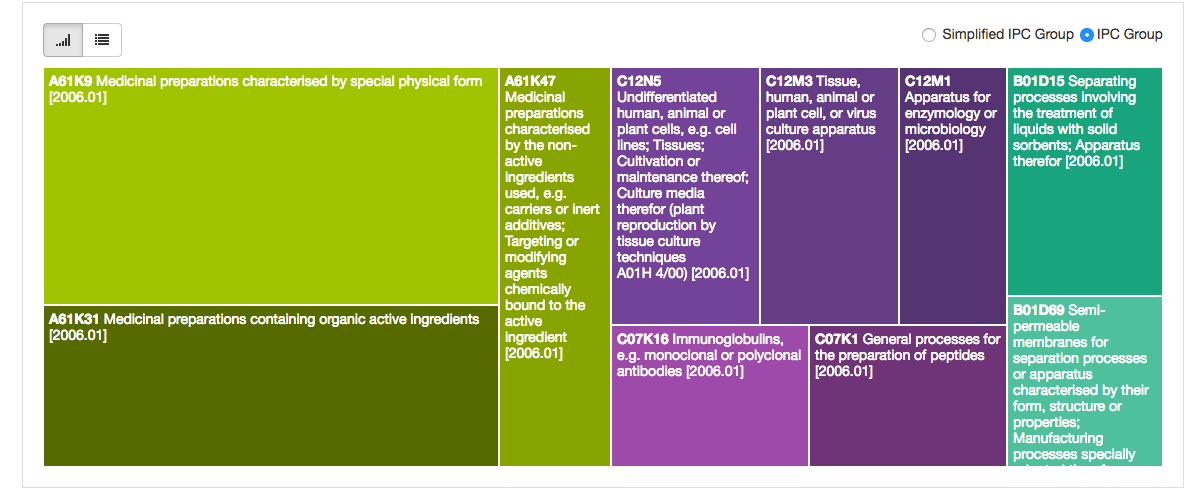

IPC distribution shows key technology interests

The international patent classification (IPC) is like a library code for different technologies described in patents. An IPC chart can show the different technology classes into which a company’s patents fall. For example, below is an IPC chart for Patheon’s patent portfolio. If your company has patents in an IPC where a potential acquirer has recently started filing patents, it could suggest good technological compatibility. This could be used to justify a particular exit strategy to investors.

(PatSnap platform)

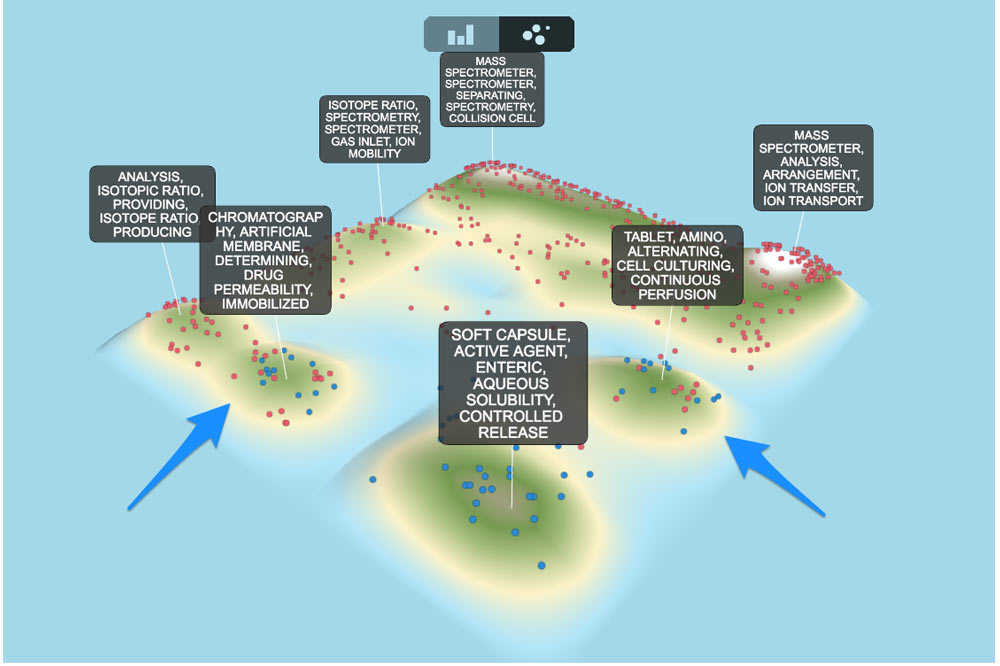

Patent landscapes

You can also perform a patent landscape analysis, especially if your investors aren’t technical experts. The landscape will display, in a clear and easily digestible visual format, where your patent portfolio overlaps with a potential acquirer’s.

For example, a patent landscape reveals that Patheon was innovating in a niche area—one in which Thermo Fisher had filed only a few patents. Thermo Fisher’s acquisition of Patheon could have been spurred by its desire to move into this niche technology area.

(PatSnap platform)

Patent data is no longer solely used for FTO and patentability. It’s a rich data set than you can use to evaluate the strengths and weaknesses of a company’s portfolio. When presenting your exit strategy to investors, using patent data can help you show your investors the value of your IP and help justify your chosen exit strategy.