New entrants lead innovation in sustainable packaging

The nature of product packaging is likely to change dramatically by 2020 as single-use plastics are phased out. Regulation is forcing companies to reduce their usage of virgin plastics. There are several strategies companies could pursue to reduce dependence on virgin plastics, but not all are equal.

Using PatSnap Analytics, we have analysed the current intellectual property (IP) filings of modern innovators in sustainable packaging and the PET recovery or working-up technology areas to reveal signals about how this market, its players, and how their technologies, are evolving.

Our analysis has found that the fields of plastic recovery and working-up are crying out for innovation. Companies filing in this space could go on to control the growing market for recyclable and re-usable plastics used in packaging.

Regulation from China, in the form of the National Sword policy, saw the ban on importing waste plastics begin in December 2017; in January 2018, the European Union (EU) announced its plastic waste reduction strategy, which aims to make all plastic packaging in the EU recyclable by 2030.

Following this numerous companies have pledged to reduce plastic usage, including:

- Mondelēz International announced that it will make all of its packaging recyclable by 2025, as the company aims to reduce waste levels and create a circular economy for packaging.

- PepsiCo signed a multi-year supply agreement with sustainable packaging producer Loop Industries and will begin incorporating Loop’s plastic into its product packaging by early 2020.

- Nestlé announced its ambition to make all packaging recyclable or reusable by 2025.

Innovation and filing trends

Insights by PatSnap shows you, among other things, the rate of patent filing in a specified area of interest. Reviewing the filing trends over time may provide a gauge of how early or mature a certain technology area is.

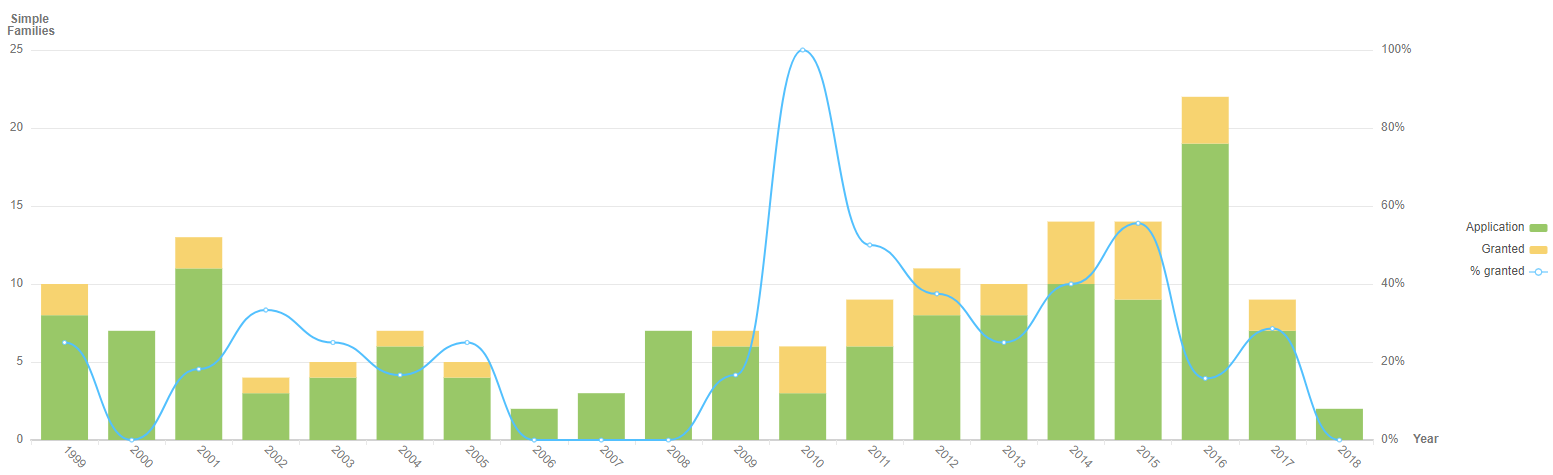

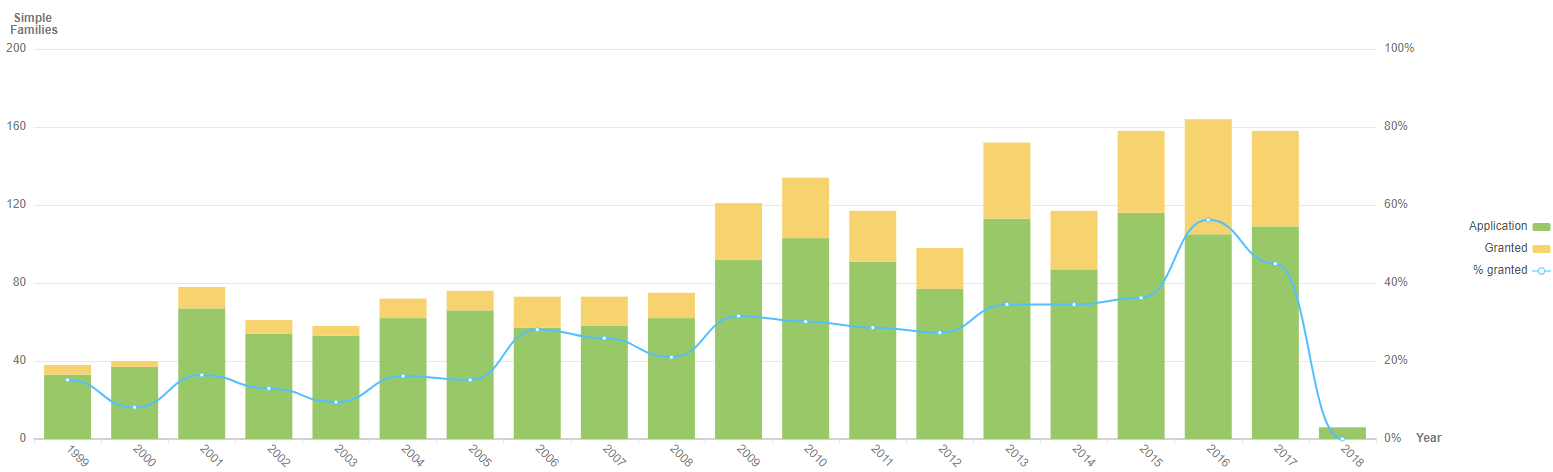

The charts below show how the innovation rates for PET recovery and sustainable packaging has changed over the past 20 years. While PET recovery has seen an uptick in patent filings in 2016, it is clear there is no real trend in either search queries which may indicate an industry which is innovating at pace.

This is perhaps not so surprising when considering that this is an issue which companies are facing primarily due to regulatory change. This was, and is, a space crying out for innovation.

- What can you learn about developments related to sustainable packaging and PET recovery or working-up from patented technologies and filing trends?

- Can your company find game-changing partners or potential acquisitions?

- What opportunities exist in this space for R&D to patent? Which direction is the market heading in?

Download our whitepaper: Sustainable packaging innovation and trends.

Technology focus

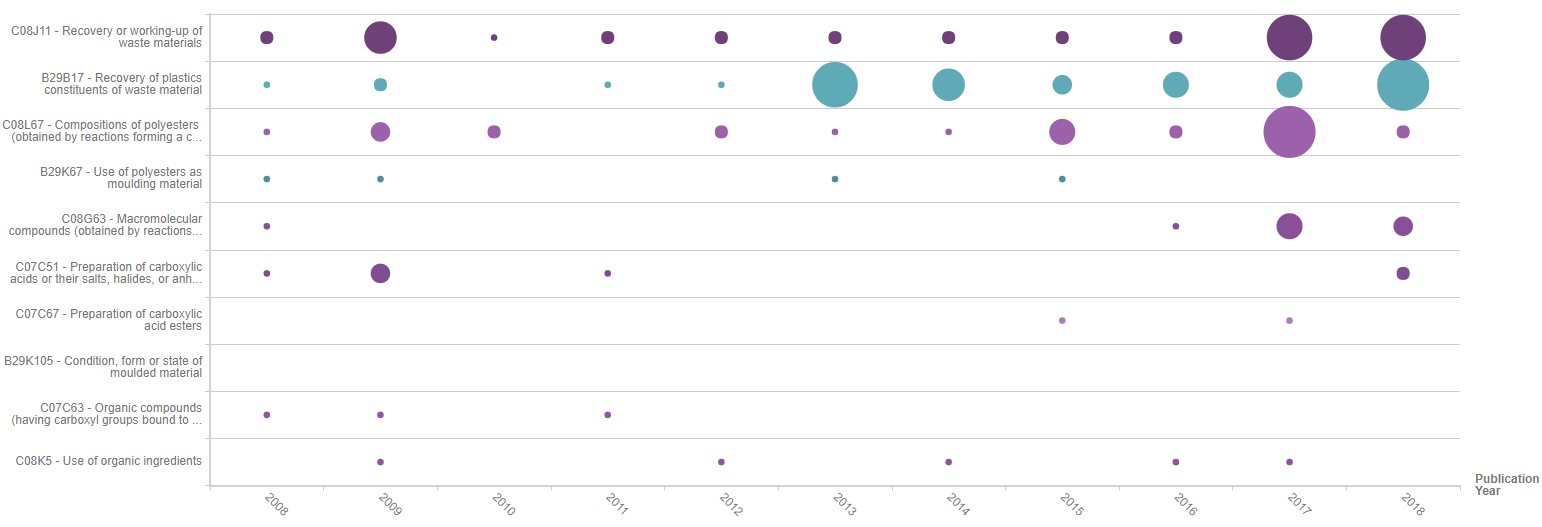

One approach to understanding how the technological direction and investment in different applications of the searched technology has changed, over time, is to consider the yearly trend of published patents by technology area.

Analysing patent filings by the groups and sub-groups of IPC codes on an annual basis provides a deeper understanding of a given technology domain.

The chart below shows that the area of Recovery or working-up of waste materials and Recovery of plastics constituents of waste material have the most number of patents filed in 2017 and 2018. For the area of Recovery or working-up of waste materials there have been only a small number of filings over the past 10 years, and many of these areas have seen no patenting activity of the past 10 years.

Knowing who the companies filing in these areas are in advance of your competition would allow you to move your packaging to more sustainable sources, at a faster rate, and win the race to zero waste.

Which companies are leading patent filings in this area?

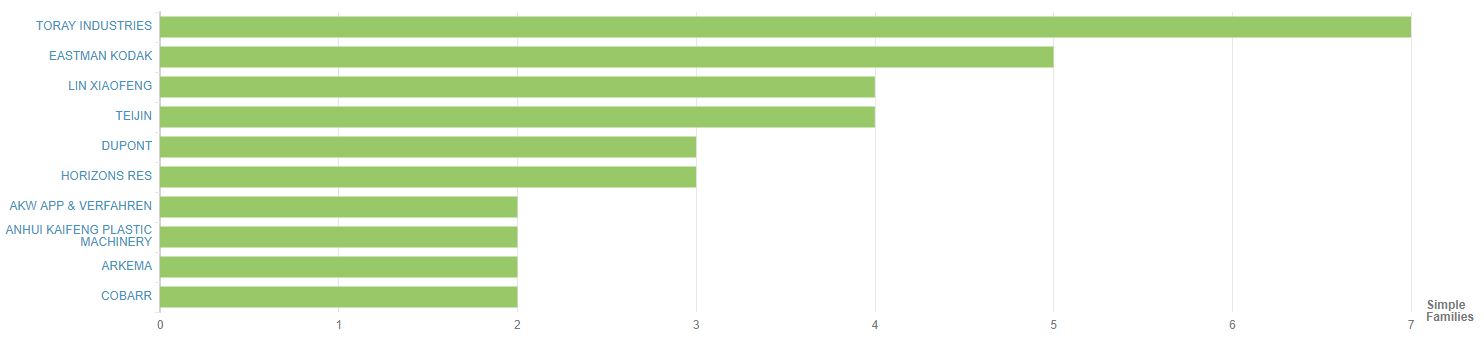

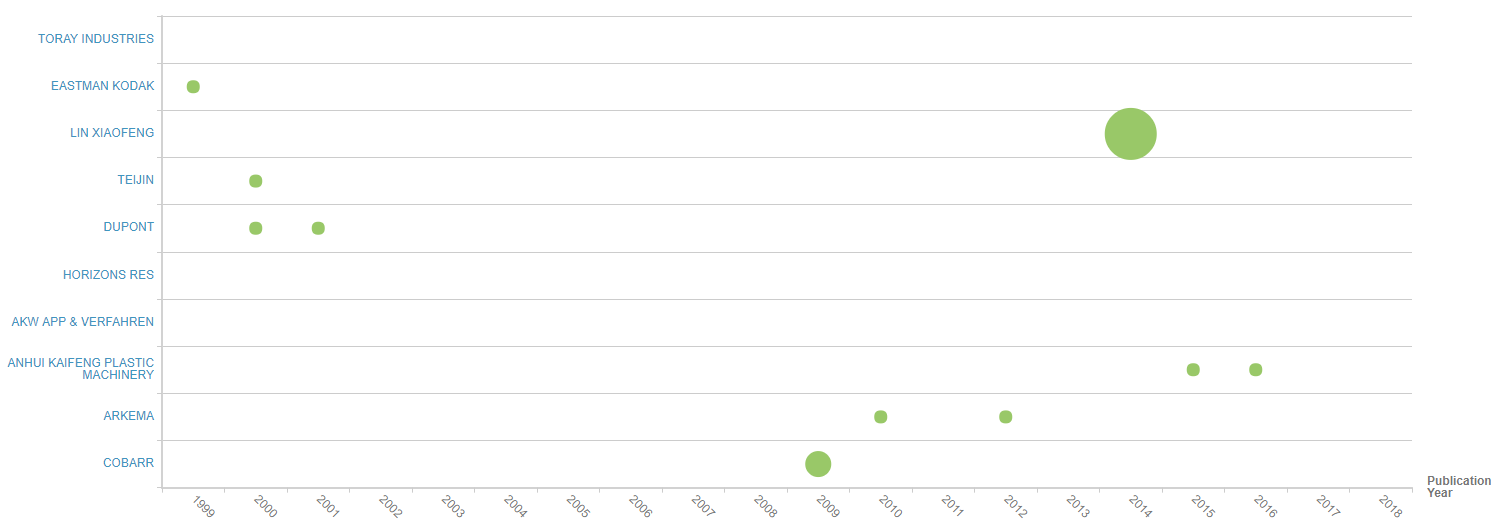

The chart below shows the top ten companies which have filed patents in the PET recovery or working-up area. The main applicants include Toray Industries, Eastman Kodak, Teijin, DuPont, and Arkema, all chemicals businesses with some speciality in plastics.

Breaking this down into an annual filing rate provides further insight. The chart below shows that none of these companies have been contributing in a meaningful way to the innovation occurring within this technology field.

Who are the innovators?

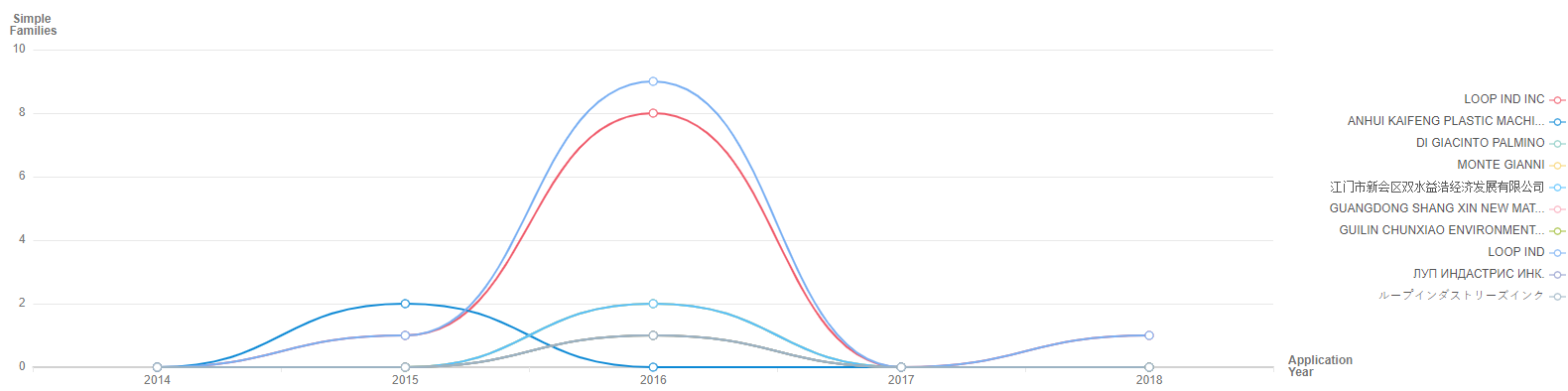

The chart below shows new companies that have recently entered this technology area. These companies have only begun filing patent applications in this area within the last 5 years. Loop Industries, under both Loop Industries and Loop Industries Inc., appears to be the most prolific new entrant in this PET recovery and up-working area.

Dubbed the “Intel Inside of circular plastics”, Loop Industries hold a patent which refers to Polyethylene terephthalate depolymerization, a chemical recycling process used to break down waste PET and polyester into their monomer building blocks. The monomers – dimethyl terephthalate (DMT) and monoethylene glycol (MEG) – are purified, removing all colouring, additives and impurities. Finally, they are repolymerised into PET plastic with the same quality as virgin feedstock, and one that meets FDA requirements for use in food-grade packaging.

The company has commercial deals to supply large consumer brands such as L’Oréal, Gatorade, and Evian, and a partnership with Indorama Ventures one of the world’s leading petrochemical producers.

Combining market signals and patent data analysis can provide deeper insights – and hints at which companies may go on to control the growing market for recyclable and re-usable plastics used in packaging.

The race to zero waste is on – is your company positioned to win?

To find out more about R&D and innovation trends in sustainable packaging, download our free 18-page report. It uses patent data analysis to reveal innovation opportunities, and explores the current patent and competitive landscape, and how this technology area is changing.