Stage-Gate Process in New Product Development (NPD)

The Stage-Gate process can be defined as a framework where large innovation programmes are divided into phases (stage). Each phase is preceded by a review session (gate), where ideas are assessed and deemed worthy of further development or not.

Just as Stage-Gate exposed the gaps within organisational processes, innovative organisations are revealing gaps within the Stage-Gate process.

Run a Google search on “weaknesses of Stage-Gate” and you won’t be short of results. Like this R&D today article, which criticises the standardised nature of stage-gates.

Or this Accenture report which claims that stage-gates can kill innovation.

CEB (of Gartner) found in its 2017 survey of senior R&D leaders that they are still wrestling with many of the challenges that Stage-Gate was supposed to alleviate. Top of the list of challenges is “We struggle to communicate the return on investment of our R&D”.

On the surface, it may appear as if the Stage-Gate process is failing to remove fuzziness from innovation—as it promises to do.

But an alternative view suggests Stage-Gate isn’t the problem—the way it’s being used by organisations might be.

I’ll explore how organisations might be hurting their results by misunderstanding the role of their Stage-Gate process —and how you can upgrade yours.

Stage-Gate is not the vehicle, it’s the chassis—you need other parts to get anywhere

There’s a dark spectre that hovers over the spirit of innovation—it’s called risk.

When your job is to constantly step into the realm of the unknown, it follows logically that you *cannot* predict whether you’re making the right moves.

This is compounded by the fact that persistently breaking through limitations is expensive. Like, trillions of dollars kind of expensive. Which means R&D is funded by commerce.

Business people prioritise predictability and calculable returns on their investment (it’s how they got so rich). Innovation offers minimal predictability (at best). You see how things can get tense.

Stage-Gate has been so enthusiastically embraced by innovative organisations perhaps because they think it helps them minimise risk and maximise predictability.

In fact, it doesn’t—it simply accounts for the existence of risk.

To illustrate, the fact that a project passes through all phases of the stage-gate isn’t an inherent indication that it is likely to succeed in the market. It’s simply an indication that a group of people have regularly asked themselves whether they think that project is likely to succeed.

Robert Cooper, pioneer of Stage-Gate, seems to me to suggest as much in his in-depth analysis of how the methodology has evolved:

“Today’s fast-paced Stage-Gate is flexible, allowing the project team considerable latitude in deciding what actions are needed and what deliverables are appropriate for each gate, and adapting to dynamic information.”

Stage-Gate is just a shell—for it to drive you to the promised land, you need to regularly fine-tune the engine you put inside it.

What really affects the success of a project is the quality of the metrics used when assessing whether that project is equipped to exploit opportunities and avoid dangers.

So, I’d like to talk about a source of high-quality metrics that can turn your Stage-Gate process into a supercar, with a turbo-charged engine— IP data.

Specifically, I’ll talk about why intellectual property (IP) data is more insight-driven, actionable and R&D-friendly than most other data sources.

Napoleon Bonaparte said, “War is 99% information…” (and so is innovation)

Clues as to the value of data are evident in most reports assessing the challenges faced by R&D-intensive organisations.

The CEB report referenced at the beginning of this article includes in its list of top challenges, “Not knowing how to incorporate analytics into the innovation process,” and “Not knowing how to make the best use of digital tools .”

Even Robert Cooper says that “adapting to dynamic information” is a prerequisite for success.

Stage-Gate is great but it’s no panacea—and while it can incorporate data, it’s not itself a source of the kind of data that helps you win outside your organisation.

It can give you data about how your internal ideas compare with each other—but how about when your ideas need to win against external conditions?

Organisations try to use a perfectly good tool (i.e. Stage-Gate) as a metric for gauging the wrong outcome (i.e. chances against external risk), so they fail.

But they’re unable to diagnose the cause of their failure—they’ve implemented Stage-Gate, after all. And when companies don’t know how to manage risk, they avoid it.

Risk and innovation are joined at the hip—avoiding risk means avoiding innovation. Risk should be managed, not avoided.

Accenture reports in its study of the Stage-Gate process that “Driven by risk aversion and poor risk management capabilities, the [stage-gate] process often weeds out big ideas in favour of small ones.”

Keary Crawford, an innovation consultant, notes in her Innovation Excellence article:

“…the new work setting can inadvertently lead to powerful “bunker mentalities” that are highly resistant to change, and a culture that favours risk-elimination over the critical risk-reward calculus needed in today’s complex business environment.”

And this is the first dimension in which IP data starts to shine.

Why focus on IP data?

Patents are a monopoly right granted by the state, in exchange for publishing details of how your invention works.

Meaning each patent makes public lots of valuable technical information—and just because you can’t copy that information doesn’t mean you can’t use it.

Patents are also documents which follow a defined structure —for example, all patents contain claims, drawings, summary pages etc. And the type of information contained in each section is clearly defined.

There are also hundreds of millions of patent documents in existence today. This uniformity means, with enough computing power, you can extract patterns and insight from billions of common data points.

IP data is particularly useful to R&D teams and Stage-Gate because:

- It is inherently biased towards providing insight (not just numbers)—it comprises a combination of quantitative (numbers-based) and qualitative (descriptive) data

- It is still overlooked by most companies and so represents a huge competitive advantage for those who use it

- Its records go back to the 1700s, so trends in the data have a healthy historical context

- It contains data about what competitors and other external parties are doing

- It contains data indicating the past, current and future direction of markets

- It is inherently innovation-focussed because it concerns multiple aspects (e.g. technological and legal) of new inventions

I must emphasise that patent data isn’t valuable as a blunt measure of how innovative a company or market is— this is a common and damaging misconception. Not all innovative ideas are patented and patenting intensity is not uniform across the world.

Insight from patent data is more useful for seeing trends in behaviour and technology. It also “telegraphs” how other innovators foresee the future and are reacting to it. And, of course, it reveals things like infringement dangers, partnership opportunities and more.

IP data is valuable in an environment where new frontiers must be continually explored because it not only reveals what companies are doing—it reveals what they are preparing to do.

This means that while you can’t predict what will happen, you can draw educated conclusions about what the market thinks is likely to happen—bringing a level of foresight to a fundamentally unknowable variable (i.e. the future).

What’s the net effect of this approach? The BCG Global Innovation Survey of 2016 shows companies that are good at exploiting data originating externally, are the same companies that have the most successful innovation programmes.

Using examples from Robert Cooper’s report, “What Leading Companies are Doing to Reinvent their NPD Processes”, I will illustrate just how IP data can help you plug holes in your Stage-Gate process.

Download this 3000-word article as an eBook-get all the insight in one convenient PDF

How IP data could have enhanced an exemplary practitioner of Stage-Gate

Mr Cooper’s report opens by pointing to Emerson Electric as being exemplary of Stage-Gate processes.

The company uses “gates with teeth”, regularly reviews its Stage-Gate process (not just the ideas passing through it) and incorporates the voice of customers, among other things.

So, I analysed Emerson’s activities and strategies to see if they could actually be enhanced by IP data. Two things were immediately apparent:

- Robert Cooper felt one of the reasons Emerson was so successful in using Stage-Gate is that it recognised that “Making the right project choices is another area where significant gains could be made.”

- Chuck Knight, the former Emerson CEO who sadly passed away earlier this month (September 2017), was renowned for making “controversial moves into the global marketplace”.

In a 2017 Economist article analysing the shift in business from globalisation to localisation , Emerson is pinpointed as “…a conglomerate that has over 100 factories outside America, sources about 80% of its production in the region where it is sold.”

Chuck Knight actually began moving Emerson into the global market soon after he became the youngest CEO of a billion-dollar company, in 1973.

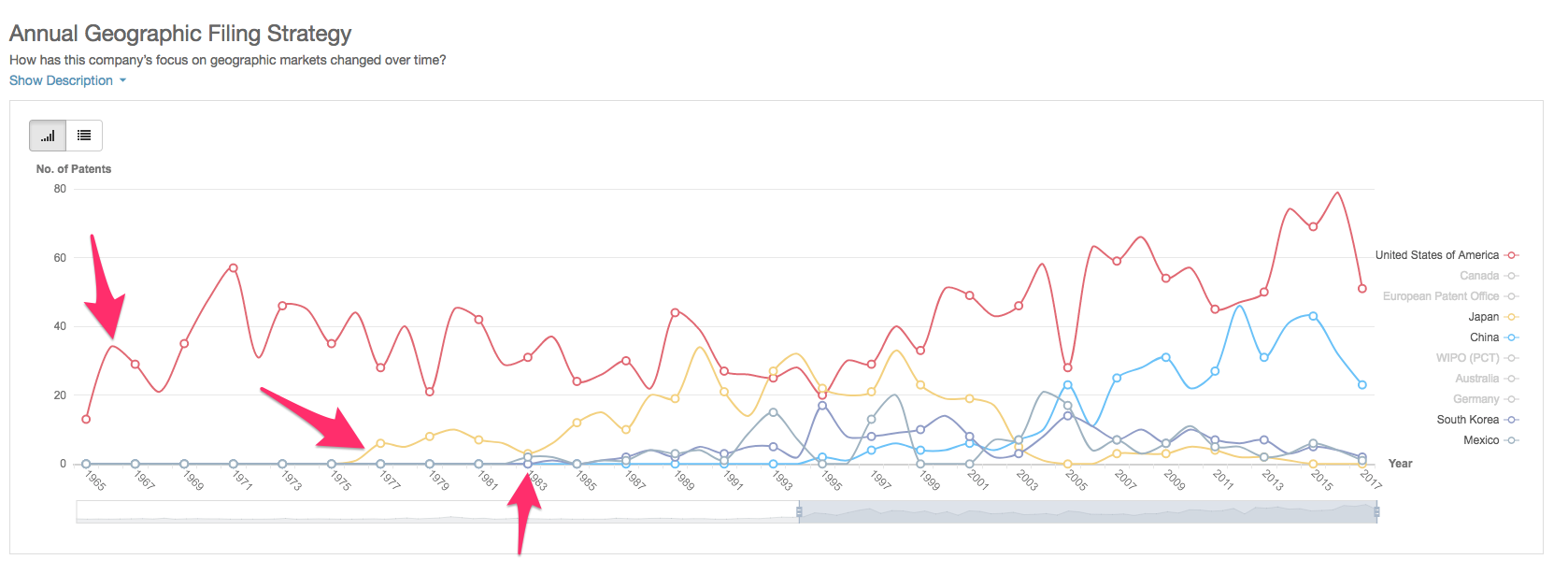

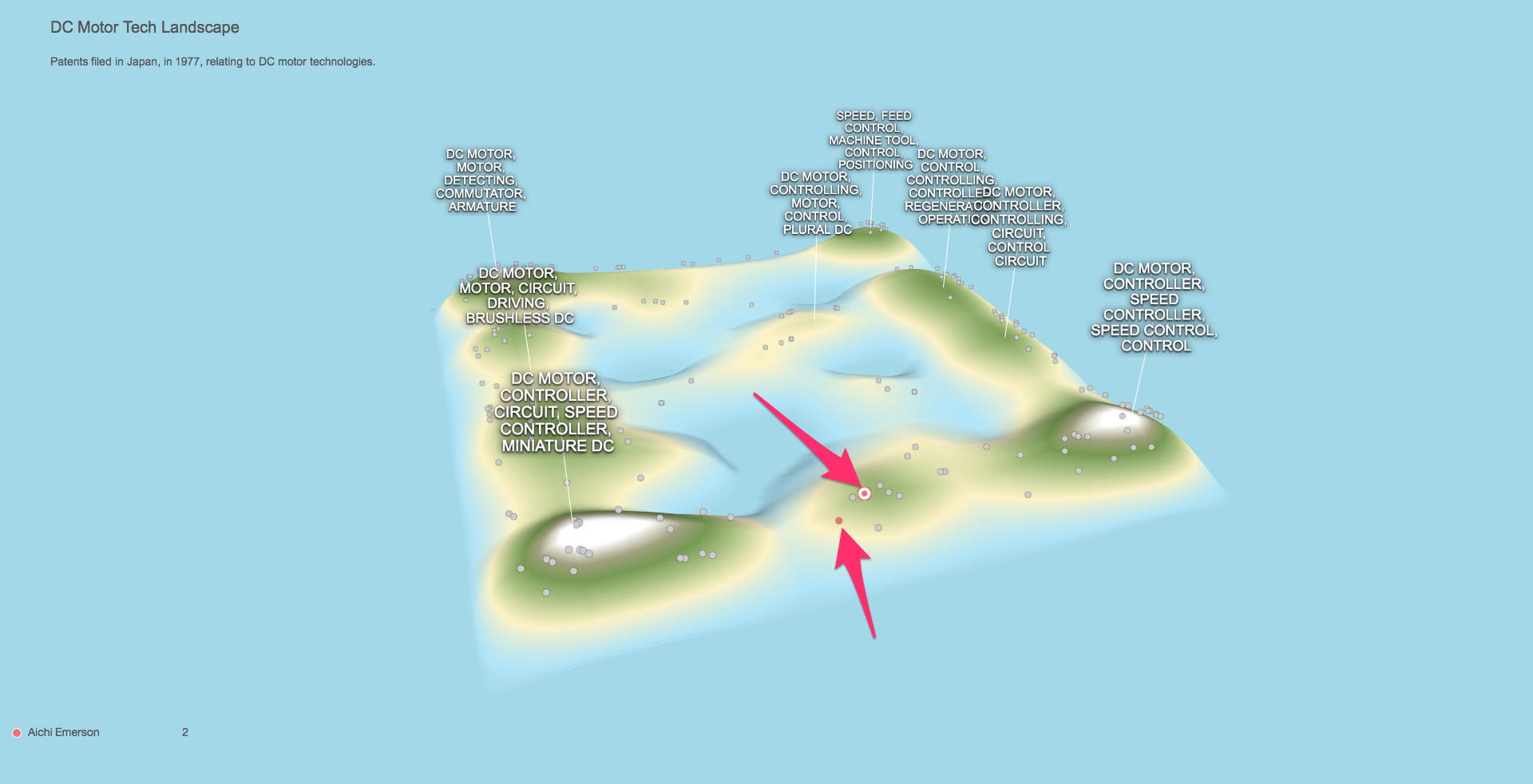

Emerson began filing patents in Japan (1977), then China and South Korea (both 1983)—while US patenting activity was already up and growing well before this time.

Emerson annual geographic patent filing strategy (source: PatSnap)

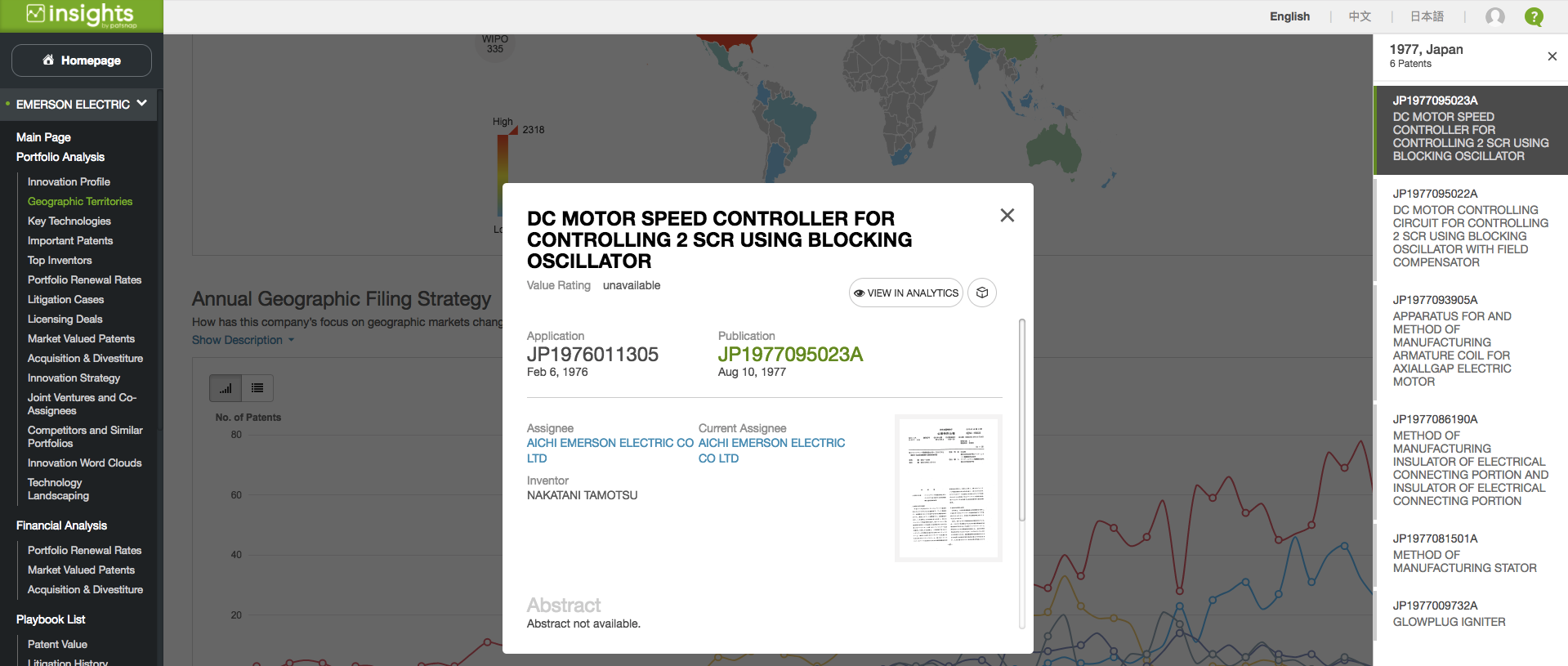

And of the 6 patents filed in 1977 (in Japan), 2 concerned “DC motors”. This indicates Emerson had spent lots of time and money on this technology area, likely with specific plans for the Japanese market.

(Source: PatSnap)

While Emerson was making the risky move of entering a new and unfamiliar market, would it not have helped to have learned from the activities of those who’d been in the market far longer?

Here’s what the technology landscape for “DC motors” looked like in 1977 Japan (with Emerson’s patents in red):

Patent landscape in 1977 Japan (source: PatSnap)

Emerson could have exploited the technical knowledge and trends revealed by the innovators in its market.

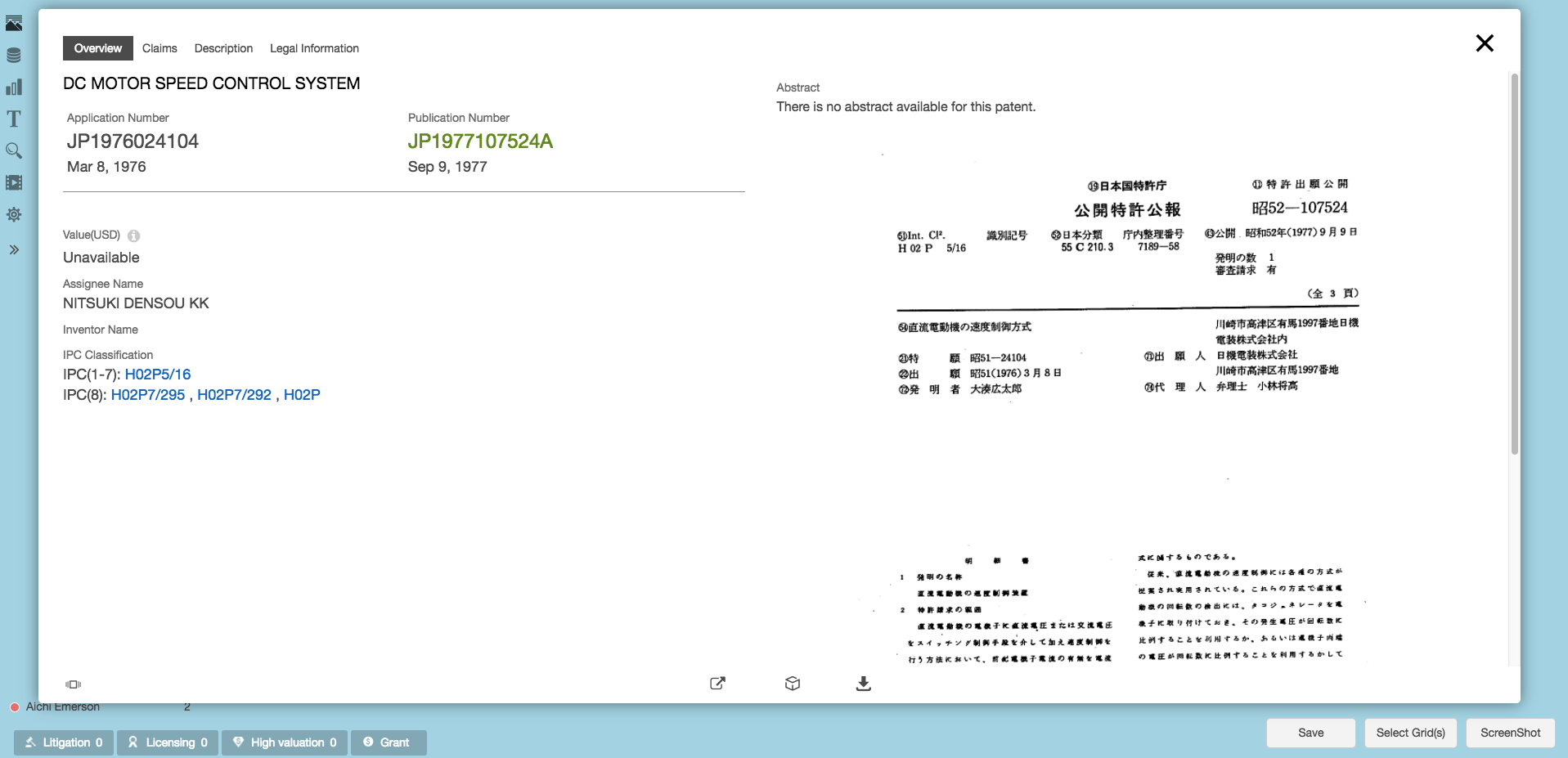

Perhaps more importantly, it could’ve seen that Nitsuki Densou KK filed a patent in the same year, relating to a technology that was eerily close to one of Emerson’s—DC motor speed control.

(Source: PatSnap)

How does this relate to Stage-Gate? Emerson’s focus on “localised internationalisation” began in 1973 and remains today (based on the 2017 Economist article). So, this scenario has likely repeated itself after Emerson’s adoption of Stage-Gate.

Maybe when it began patenting in Colombia (1995) or Indonesia (1999).

As established by Robert Cooper, “adapting to dynamic information” is a key tenet of a flexible and effective Stage-Gate process.

Is there a better illustration of adapting to dynamic information than exploiting the current (and evolving) trends in IP analytics, as a company enters a new market?

IP data would enhance not only the choice of ideas to develop (with infringement and partnership opportunities laid bare on the landscape), but also the direction of development (with ample technical information rendered accessible).

And I can guess what you’re (probably) thinking: that the kind of computing power necessary to access this information wasn’t available in 1977.

That’s true. Yet many modern organisations still make uninformed decisions, as if such rich and actionable data were not available today.

That makes Emerson’s example from 1977 more apt. Whereas IP big data used to be inaccessible to all companies—nowadays, most organisations choose to ignore it at their own peril.

Combine IP data with Stage-Gate to boldly go where no man has gone before

Robert Cooper, in his in-depth report, itemises ways to improve several facets of Stage-Gate—I’m going to explain how IP data can support you in 3 main areas.

-

Optimise your Stage-Gate process by making it risk-adjusted and scalable

Robert Cooper states that one of the big mistakes organisations make is having “gates with no teeth”—i.e. stage reviews that amount to knowledge-sharing sessions, rather than opportunities to weed out bad ideas and reinforce good ones.

He emphasises the importance of “go/kill decision points”, stating:

“In many firms, too much emphasis is on getting through the process—that is, on getting one’s project approved or deliverables prepared for the next gate… In a major shift, P&G changed its emphasis to winning in the marketplace as the goal…”

He also mentions the importance of having truncated versions of stage-gate, to handle smaller, lower-risk projects (which don’t require the bureaucracy of the whole shebang). These truncated versions would presumably contain appropriately miniaturised “teeth”.

IP data is one of the few sources of innovation intel that can keep up with fast-moving product development pipelines—and provide big or small data.

Scott Collins, President and CTO of TeVido, states that one of the big benefits of IP data to his company is that it alerts him to new developments in the company’s technology area.

Numerous patents are filed every day, across the world. With access to current IP data and insight, you can see if an infringement threat or novel application appears half-way through a project life cycle.

You can adjust commercialisation strategies with the emergence of licensing or partnership opportunities, and use countless other data points to keep your project on track.

If you’re dealing with a big project, you can dig deep into the IP data. If you’re dealing with small projects, surface readings of patterns can give quick indications on how to proceed.

-

Improve your Stage-Gate process by adding flexibility, using simultaneous execution

Robert Cooper explains, “Today, stages are even allowed to overlap in NexGen Stage-Gate… long lead-time activities that are usually reserved for subsequent stages (e.g. …preparation of marketing collaterals…) can be moved into the previous stage to accelerate the project…”

But he also says, “Simultaneous execution usually adds risk to a project.”

If you’re going to start printing marketing collateral before a project is finalised, you need to be able to prevent what ex-Xerox R&D chief, Mark Myers, calls the “Oops Factor”. This is a situation where companies forge ahead with a project only to discover (millions of dollars later) that it can’t be commercialised.

Often, obstacles to the commercialisation of ideas are patents. If you’re in the business of R&D—especially if you want to make your Stage-Gate process more flexible— it’s simply reckless to ignore IP data.

Just ask Dow Chemical, which was forced to dismantle an entire business unit and abandon a multi-million dollar project because it failed to keep an eye on the IP landscape.

-

Improve your Stage-Gate process by focussing on portfolio management

Robert Cooper notes, “There are two ways to win at new products: doing projects right and doing the right projects. And that’s where portfolio management—picking the right projects—comes into play.”

He also notes, “Lack of data integrity is one of the top issues identified in a recent APQC portfolio management study.”

IP data is valuable because the issue of data integrity is neutralised —all patent documents are reviewed and approved by independent bodies, following long-standing criteria.

Concurrently, IP data works well as either a “shield” (for defending the value of a project) or a “sword” (for cutting down flawed ideas). It reveals threats (e.g. competitor strategies and infringement dangers) as well as opportunities (technological trends and partnerships).

John Frieden, R&D Director at Wilbur Ellis, says about IP data, “I expect over time, the next innovation we come up with will have been found based on PatSnap’s patent reports— it has improved my success rate.”

In short, give your Stage-Gate process an IP data-driven engine

I won’t suggest IP data is the solution to all Stage-Gate related problems. But I think it’s fair to say, you’ll never own a fully optimised process unless you incorporate IP data.

Don’t strategise as if your Stage-Gate process needs to operate by the rules that existed in 1977, when your business needs to win on the competitive landscape of 2017.

I’ll leave you with Robert Cooper’s closing words from his report on the Stage-Gate process:

“Take a hard look at your current and potentially out-of-date NPD process and systematically reinvent the process to build in the latest thinking, approaches and methods in order to move to the NexGen Stage-Gate system.”